Entrepreneurs are people who spot pain points in the way we go about our daily routines and launch businesses to fill these gaps, thereby giving rise to a business model. Entrepreneurship involves taking a lot of risk to create something new from scratch. However, entrepreneurship comes with its own unique set of hard challenges. The uncertainty of miscalculating an opportunity could lead to a situation when unfortunate events occur. Further other risks associated with being an entrepreneur include building a brand with no established credibility and failing to innovate or keep up with the needs of your target market, misguided marketing strategies, bad hiring decisions and the pressure to maintain a steady flow of customers.

The path to stabilizing a business and being successful goes through a series of slip-ups and mistakes. However the difference between letting go and riding the toughest times can be taking inspiration from people who have successfully gone through these phases. Some of these successful people include Bill Gates, Mark Zuckerberg, Steve Jobs and Carlos Slim.

Bill Gates dropped out of Harvard and a year later co-founded Microsoft, the Company that would eventually make him the world’s wealthiest man. Bill Gates says entrepreneurs need to have a keen eye for detail and never lose track of his team. Gates believed that as the scale of operation of your business grows, more employees will come on board and it is essential to keep a close eye on the team and the Company’s output. Bill Gates also puts a lot of importance on criticism, which if taken correctly can turn into an area of strength for your business. Criticism from customers and clients is vital to moving a business forward and helps companies improve their product offerings.

Mark Zuckerberg, who has built Facebook into one of the world’s leading internet businesses, opines that it is essential to think long term and to understand that one cannot tackle all the problems by themselves. It is imperative to find and build a team with the right set of people who can complement you and focus on different sets and different scale of problems. Zuckerberg also believes that entrepreneurs should go after the hard problems and not to lose sight of that target and settle for something easy in the process. If the business solves a fundamental problem, it would be worth the time and effort that people have put in it.

One of the foremost and greatest entrepreneurs of our time, Steve Jobs, the man who built Apple into the most valuable company in the world was a firm believer of perseverance. According to Jobs, the differentiating factor between the successful and non-successful entrepreneurs is purely based on how well one persevered.

An entrepreneur can think of and have the greatest idea in the world, but it is his perseverance and persistence that takes him a long way towards achieving what he dreamt of. Also, according to Jobs, the more you love your dream and make it your passion; the more likely it is that you will succeed in your endeavours. He believed that success for an entrepreneur is dependent on how determined you are in attaining your dreams.

Carlos Slim, one of the world’s richest people, has been an entrepreneur since a very early age. According to Slim, it is the essential things that add value to any proposition. So, more focus should be placed on these essentials, rather than on factors that tend to slower the pace. These road blocks will surely not add any value.

He firmly believes that when an entrepreneur and organization has a clear and focused growth strategy supported with strong execution infrastructure, they are bound to taste success.

India’s richest man, Mukesh Ambani, believes that it is essential to dream big and focus on growth. Growth through focus is the right strategy to adopt when you are growing your business. Having a dream and working towards it is the most essential thing for any business. This also helps entrepreneurs overcome obstacles that come in the way of achieving their dream and growing. He believes that there is no substitute for hard work and there are no shortcuts to success.

So there it is – five bits of advice from some of the most successful entrepreneurs in today’s world. Follow them and internalise them in your respective business systems – success is bound to follow!

Post By NeoGrowth Credit – Business Loans specially created for Retailers & Online Sellers

For more Information – email us on digital@neogrowth.in

Or Give Missed Call @ 08080861166

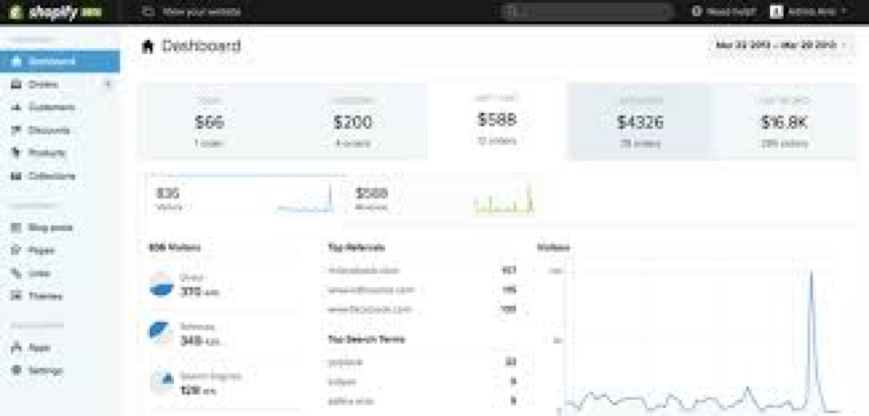

Lending, one of the primary functions of the business, is also changing. Various players like

Lending, one of the primary functions of the business, is also changing. Various players like