The mother of all internet businesses, e-commerce is a constantly evolving segment. The galloping pace of evolution is certainly exciting and if you are looking to match steps, you must get a handle on marketing and analytics. These two are the cornerstones of success in the field of e-commerce. Unfortunately, many businesses do not give them due importance, realizing little that it will give their competitors a huge edge and the latter can easily become the go-to destination for customers.

Why are marketing and analytics important?

Probably, the reason behind the lack of interest is the inability of entrepreneurs to understand the significance of marketing and analytics in the success of their business. Well, the fact is that e-commerce is a highly competitive niche and the customers are spread far and wide, who can be only engaged through intensive marketing and quality service. The second reason is that multiple variables operate in the e-commerce sphere at the same time and to tap into their potential, businesses need correct analysis and reports. Last but not the least, the decision-making process of this segment demand quick thinking and detailed analysis.

So, which are the areas where marketing and analytics come into play?

Below is a detailed explanation.

Product/service offering

Your key offering i.e. products/services gives you great insights regarding consumer behavior and needs. Your product page is a source of huge data and you can dig into it to perform better. It will help you find out the satisfaction rate, identify the customer queries/interests, demographic specific demands, engagement density and many more things. You can also make a sales forecast on this basis, and modify your marketing and sales accordingly.

User experience

User experience plays a very important role in the success of your business and thus, it is important to understand what is engaging and annoying the user. The user related data, such as how much time they spend, how do they search, which is the best landing page, what holds their attention, reviews, etc. form a part of the analytics. It is studied to improve the user experience so that there are more conversions and your position is solidified as a brand.

Supply chain management

Supply chain management is an integral part of e-commerce, especially in retail, and it revolves around logistics. Logistics involves heaps of data related to pricing, transportation cost, human power, etc. In fact, this is one of the pillars on which e-commerce industry stands. It plays a key role in customer satisfaction and can make or break your operations. Therefore, only those businesses which manage this aspect skillfully can hope to flourish and make profits. And to manage logistics, nothing is more suitable than analytics.

Merchant management

Merchants are the lifeblood of e-commerce business. They need to be managed and engaged so that they can help you grow as a successful enterprise. With their numbers quite high, you need to employ analytics to track the dealings, their relative performance, ability to cater to a growing customer base and other variables. With insights gained from customers’ data, you can easily engage the merchants by offering them more contracts and rewards.

Fraud detection

E-commerce is not devoid of frauds and cheating. Since it involves online transactions, the chances of getting duped are quite high. It may come from the merchant’s side or in some cases even customers. Such cases need to be handled with tact and must also be tracked carefully. With analytics, it becomes a cakewalk to detect frauds and handle them.

Marketing

E-commerce marketing is a lot about analytics. Be it SEO or AdWords spend or social media marketing, every business gets huge unstructured data on these fronts and needs to study them properly so as to get optimum return on investment. Even in terms of content marketing, one needs to analyze customer data to understand what is trending, what is being searched, which keywords are performing, what kind of content is impactful and other related things.

Bottom line

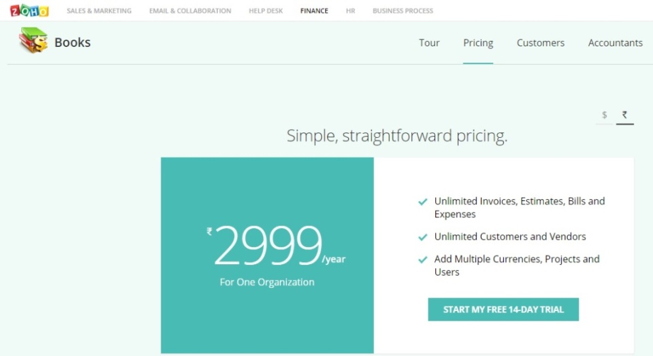

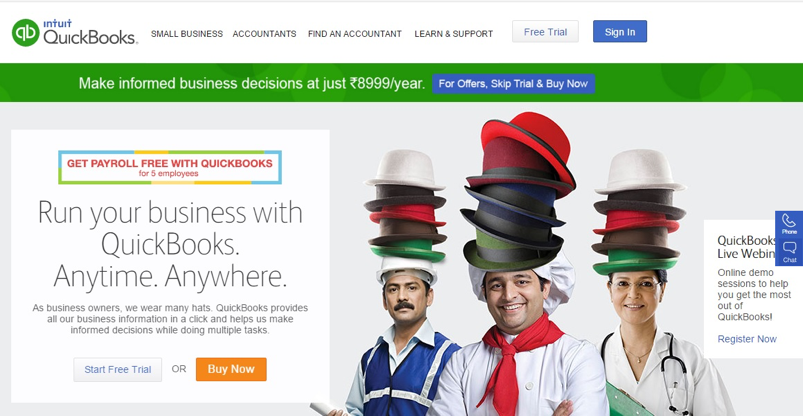

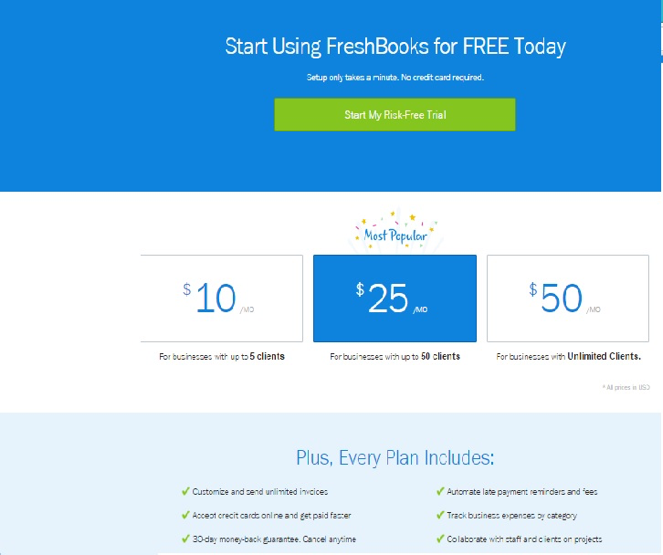

A strong data analysis framework is must for every e-commerce business as it helps you at every step in your business. And thankfully, there are many tools out there to help you in this regard. Available for free as well as at a price, these analytics tools help you a great deal in forging correct strategies for sales and customer engagement. Names like Google Analytics, KissMetrics, CrazyEgg are well-known for their efficiency and ease of use.

If you want, you can also develop personalized tools. You may need to hire an analytics expert to perform this task or you may choose to do it yourself. But if you do it yourself, you must possess great analytical skills. Whatever you invest in this area is bound to bear fruits and therefore, you must choose the right option, even if it seems costly.

Post By NeoGrowth Credit – Business Loans specially created for Retailers & Online Sellers

For more Information – email us on digital@neogrowth.in

Or Give Missed Call @ 08080861166