Importance of financial mobile apps to Business:

Challenges related to finance and accounting are faced by every small business. Be it related to finance or book-keeping, these obstacles are encountered by all. Great care and utmost caution are required while dealing with these factors as even a small accounting error may cause a multiplied effect on the balance sheet as a whole. Now, the best way that one can employ to deal with these challenges is by preventing it in the first place. And the best way to combat these obstacles include developing a system and standards, using an integrated software system that needs less manual entries, using versatile cloud-based accounting software system, educating yourself on accounting, tax and accounting problems, and partnering with a certified public accountant.

One can keep a tab on finance, accounting and book-keeping using apps on their mobile phones or tabs. Let us take a look at some useful and handy finance and book-keeping apps for your small business:

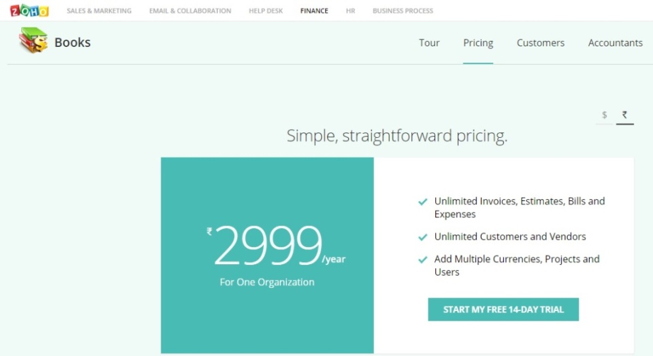

1. Zoho Books

Zoho Books organizes and manages all of your business transactions. You pay less time invoicing and chasing due payments. On-line payments offer the advantage and convenience to encourage faster payments. With Zoho Books, you’ll be able to simply keep a record of all of your estimates, invoices, credit notes, and continual invoices. Convert estimates to invoices in just a click, and with the filter you can also trace invoices which require your attention.

Zoho Books is stress-free and an easy-to-use accounting app that tracks the cash incoming and outgoing of your business. With Zoho Books, you’ll continually keep up-to-date on your business finance and create choices instantly. Some of features include-

- Sales – Manage Money Coming In

- Purchases – Manage Money Going Out

- Purchase Order

- Banking

- Quick widgets

- Tax Exclusive / Tax Inclusive rates

- Invoice Templates

- Track time accurately

- Download and Print Reports

- Accept Online Payment

- Add Attachments and Receipts

2. QuickBooks Online

QuickBooks makes accounting, billing, and payments as simple as a breeze. Run your entire business with this small business cloud accounting solution and enjoy the liberty of operating at any place from your smartphone or tablet. Some of the benefits of using this app are-

- Create and send professional looking invoices and estimates

- Get paid faster by sending invoices with a Pay Now link

- Receive payments directly on an invoice via credit card

- Do business in multiple currencies using the latest exchange rates

- See overdue invoice notifications to make sure everyone’s paying you

- Manage expenses, sales and customers on the go

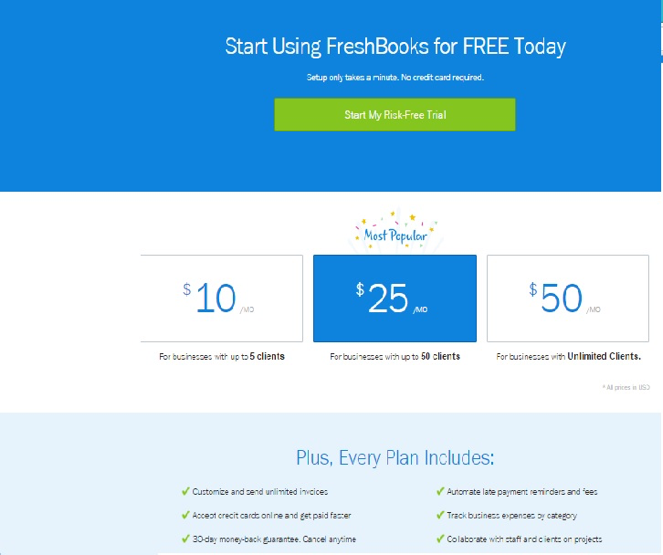

3. Freshbooks

FreshBooks enables you to create Professional Invoices in seconds. You can create professional-looking invoices complete with your own logo. When you’re ready, simply print off your invoice or email it to your client in a snap. It is exclusively designed for Small Business Owners

- Create and send professional-looking invoices and estimates

- Easily capture and manage expenses on the go

- Turn on the timer while on the clock for your client and never lose another billable second again

- Your FreshBooks account is accessible everywhere, on all your devices, to let you work from where ever you want and whenever you wish to

- Your data is backed up and secure across multiple data centers, behind a firewall with 256-bit encryption – that means if you ever lose your phone, all your data remains intact.

- The cloud accounting saves your time and helps you get paid faster.

4. Tally

This app is a tool to keep up business or personal accounts on android device in “Tally Way”.

A person having no knowledge of accounting can also utilize this tool as it is very simple and user friendly. This app makes it very simple to manage day to day accounting transaction on a mobile or a tab. The screens and operations resembles known Indian accounting package “Tally”. Even zooming is additionally provided, i.e. from final report one can reach till voucher entry.

Some of the features are –

- Creation of Masters for all sort of Accounts like Capital, Assets, Debtors, Creditors etc. Entering and maintaining Daily Transactions like Payment, Receipt, Sales and Purchase. Contra entries to manage cash deposited or withdrawn from bank. Journal Vouchers for cross account entries and final settlement entries.

- Generates Reports like Daybook, Ledger, Registers, Trial Balance and Final reports – Balance Sheet, Profit & Loss Account.

- Data is always backed up and used from the device itself. But for safety, user can take a backup in a company wise manner and store it at a desired location or can directly mail on his own mail-id. So, in case the user has formatted his phone, there is no accidental loss of data.

——-

We @NeoGrowth Credit help online sellers & retailers grow their business by providing business loans.

Post By NeoGrowth Credit – Business Loans specially created for Retailers & Online Sellers

For more Information – email us on digital@neogrowth.in

Or Give Missed Call @ 08080861166

Lending, one of the primary functions of the business, is also changing. Various players like

Lending, one of the primary functions of the business, is also changing. Various players like